Daily Market News - 11th May 2022

When Will The Carnage End?

What a week on Wall Street.

What a f***ing week,

In case you didn’t know it already, the bears are in full control and while I don’t mind that (I’m a Trend Follower so I’m flexible), I know after my Social Media Weekend analysis many of you reached out asking why I was posting so many bearish charts.

Well, if you can’t beat em, join em.

That’s what my mother taught me, and it’s good advice in a bear market.

My work pivoted to a Bearish bias 2 weeks ago for individual names, and while Energy continues to hold up well (WMB and AR from last week held up well), the low hanging fruit is to the down side and in this weeks letter I’ll share a few names I’ve shared with clients / members recently and the criteria I’m looking at.

Let’s start with the Metaverse

Most of you know by now I don’t use the magical hindsight indicator and I know many of you picked this up from Twitter the other day,

If you missed it, I posted here - Metaverse Tweet Here , our clients / members were prepped in advance and thankfully many did incredibly well on it, but what I want to share is the criteria I’m looking tor just now.

High P/E Ratios (Or No P/E Ratios), Negative 12 Month Earnings Growth, and broken charts with risk that’s easy to define.

To me, down trends work like uptrends so I don’t really sweat it as long as I can define my risk well.

Emerging Markets (EEM)

Emerging Markets are basically 40% China (that number may have changed over the last 12months) but I’m not really concerned with that… I know it’s in a down trend and I know it’s breaking down, I don’t need to know any more than that and I can define the risk.

If you like taking buy positions, Inverse ETF’s are of course always a good option, but there are also stocks like Paypal.

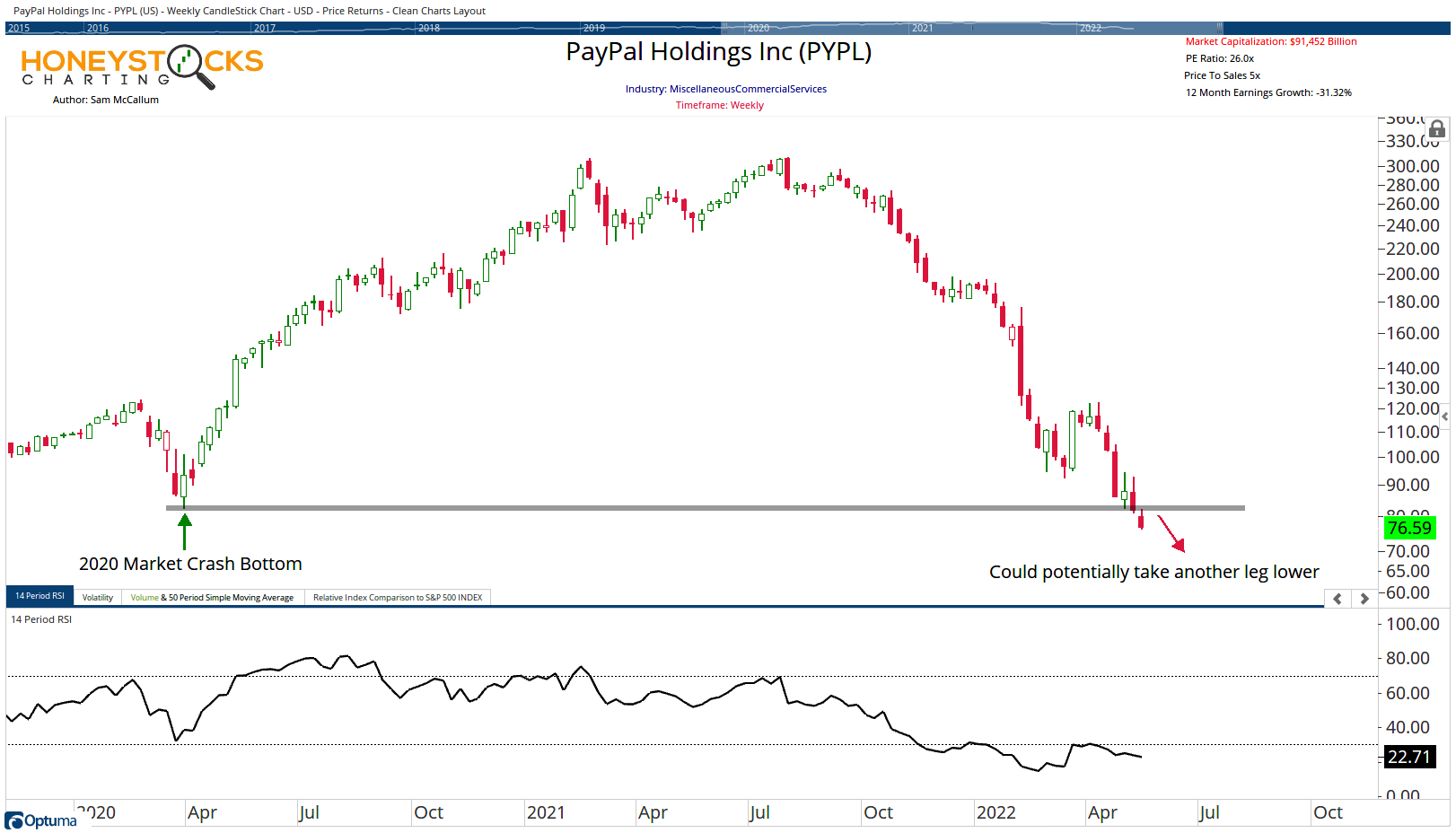

Paypal (PYPL)

I understand Paypal has been beaten to death recently, price is breaking down again and it’s threatening to take another leg lower.

It’s dipped below it’s Covid Crash lows, it’s hard to be bullish on a stock showing this much weakness.

How about Bonds?

Again, you might have missed this chart I put out to social media last week

20Yr Treasury Bond ETF and 10 Yr Note (TNX)

There MIGHT be a bit of a reversal on the cards with TLT, but whether it’s short or long term, I don’t know. But it’s a trade that’s starting to make sense with very easy to define risk.

If the 10yr comes to a grinding halt, it could be a tailwind for many beaten up areas in the short term.

I don’t know when the carnage will end, it’s incredibly messy out there, but I’ll keep on finding the best charts regardless, up or down, it don’t matter.

If you missed the free social media monthly analysis at the weekend, I’ve linked it below - feel free to check it out.

Our Time Stamped Market Calls