Daily Market News - 22nd September 2022

The Bull Case For Stocks

Everyone’s asking what it would take to get meaningfully bullish in a wrecking ball of a market.

The Fed are raising rates at the speed of light. Sentiment feels like it’s at an all time low, the VIX is spiking and we’re seeing the major averages break down and they’re looking primed to test the June lows.

It makes sense why stocks are going down.

But what about a bull case. What would that look like?

In this weeks letter, I’ll share a few charts I’m watching closely.

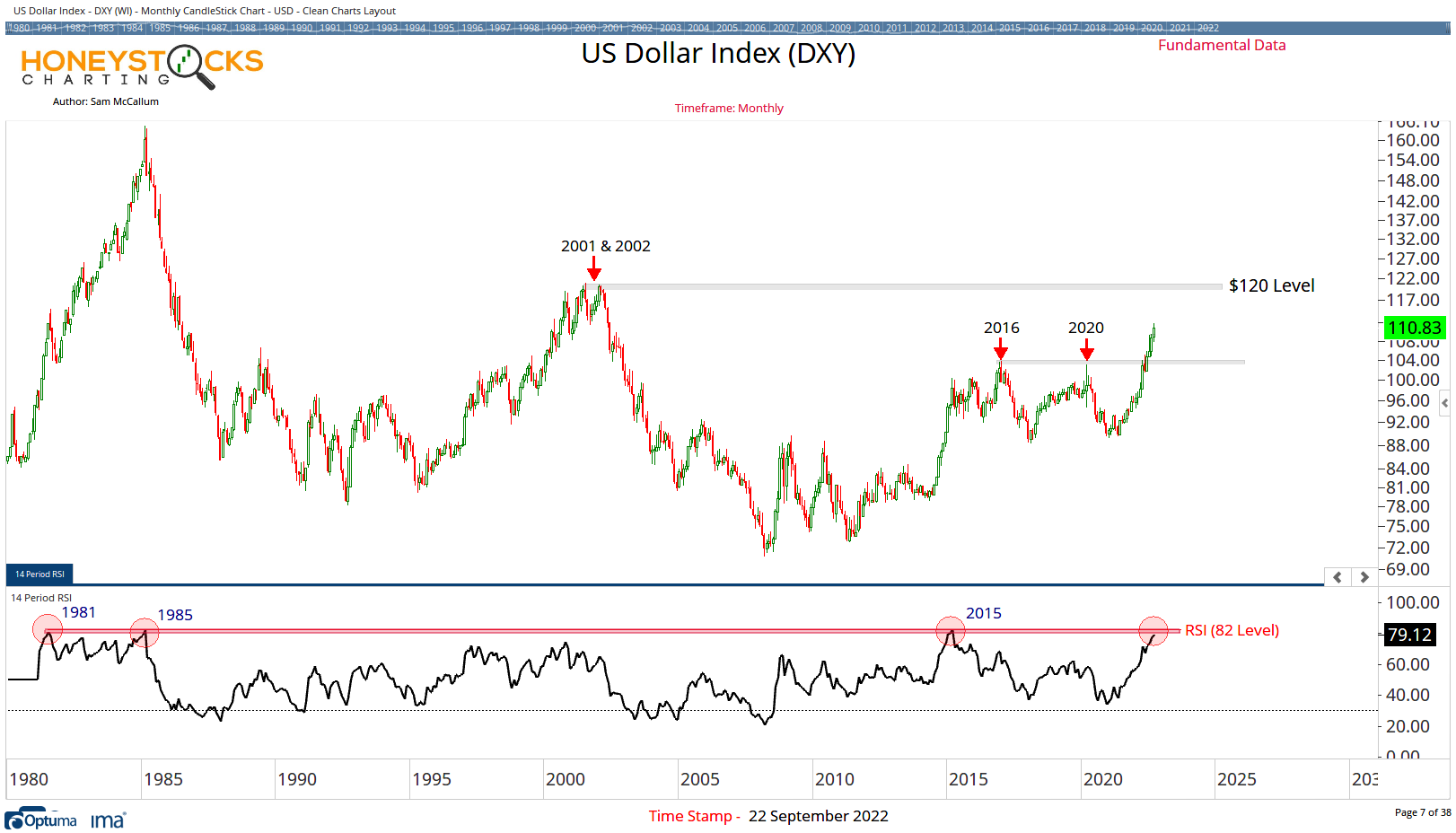

The dollar’s been THE problem for stocks over the last year. Dollar up, stocks down, I’ve been talking about it in this letter the entire year.

Zooming out on the Dollar Index shows us we’re in a massively over bought condition and approaching levels we’ve only seen in 1981, 1985 and 2015.

Let me add, I much prefer RSI as a tool on the Weekly and Daily timeframes, but in this particular chart, the monthly data looks relevant to me.

IF the dollar is going to cool off soon, what could that mean for stocks?

The Dow’s already there, back to the scene of the crime from the Covid Crash / June Lows, every Professional Analyst on the planet is watching this chart, because we know the implications of a break lower.

But what if it rebounds like it did in June? Could it potentially take the rest of the market higher?

I think that’s a reasonable assumption.

The S&P500’s broken down and put in a text book retest. I also posted this chart to Twitter yesterday - you should probably be following me - FOLLOW SAM HERE

In last weeks letter I highlighted the levels above.

Price has given us the signal, it’s now breaking down despite some of the breadth improvements we’ve been seeing.

The path of least resistance is probably lower BUT, (and it’s a BIG but) if the Dollar falls away and the Dow rebounds spectacularly, it could conceivably take SPX back above 3,900.

In Conclusion

The data suggests we’re heading to the June lows, lets be clear about that. That’s also where I’d expect a rebound.

It’s what I’ve been prepping our members for over the last week (Inverse ETF’s etc etc), but the way I learned it, it’s better to consider the other side. (just in case).

Plenty of stocks have bottomed, and plenty are looking strong, so it’s a very confusing environment for many of you reading this.

Getting meaningfully long OR short can end badly when we get the inevitable counter move. So just focus on the individual charts for the stocks you want to own or bet against.

Stay safe out there.

Our Time Stamped Market Calls