Daily Market News - 9th March 2022

Marine Ships Sailing Off

It’s been volatile over the last few weeks, Tech has been battered to death, commodities and energy have been ripping.

Having nimble footwork amidst a sea of uncertainty has probably been the approach to take.

Amidst the sea of uncertainty, there’s been a very fruitful area of the market firmly in the middle of a bull market and in todays letter, I want to share some charts and ideas within the Marine Shipping Sector.

Who knew they could move like Growth Tech names huh?

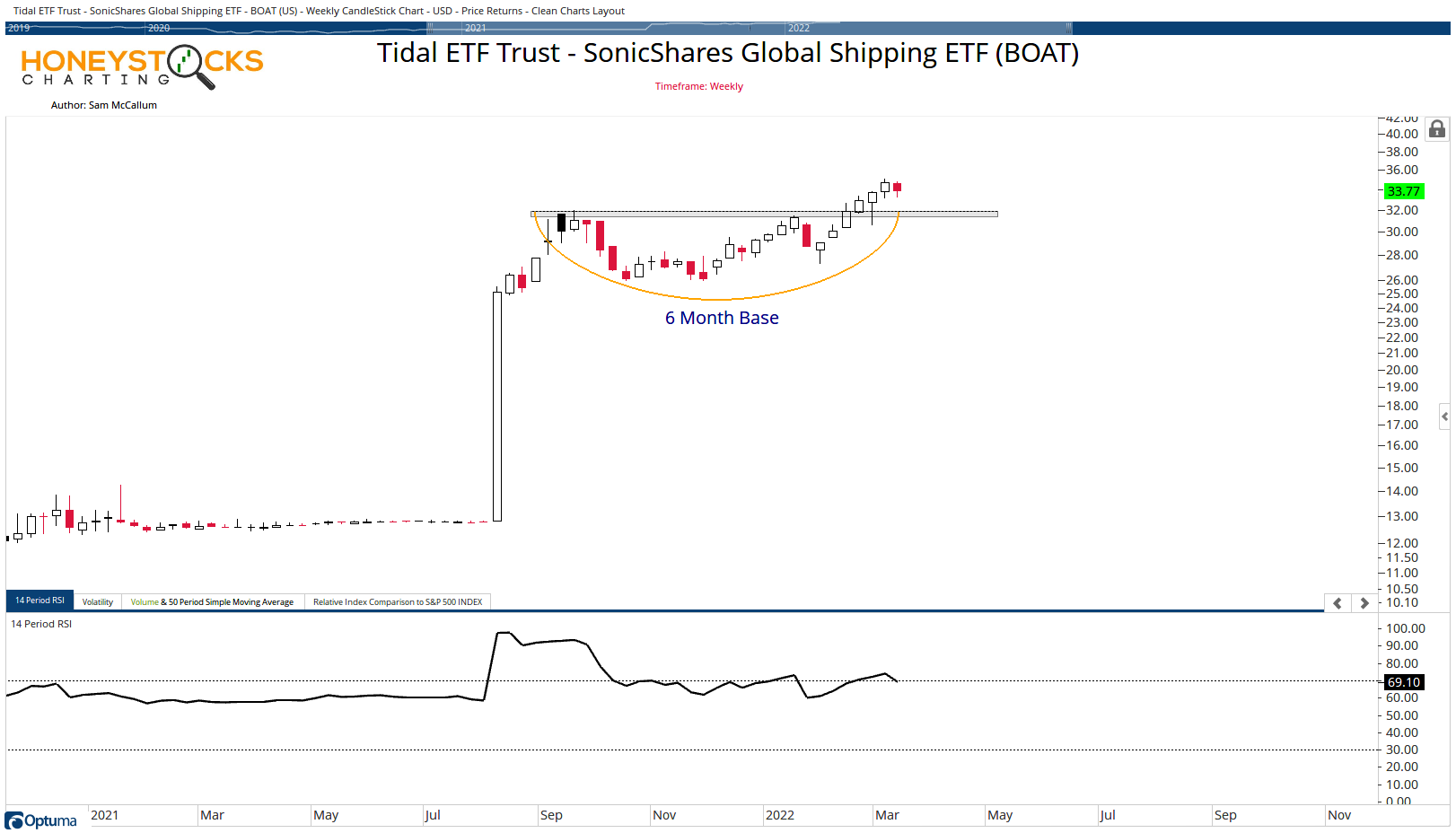

Sonic Shares Global Shipping ETF (BOAT)

A few weeks ago, I started putting some Marine Shipping names to our clients and members as a way to profit among the chop elsewhere in the market and the BOAT ETF breaking out of a 6 months base was the signal. There’s always stocks / areas going up… you just need to have a process to identify them.

Provided the BOAT ETF holds it’s break out levels and doesn’t collapse on a massive rotation back to Tech (which I’m open to the possibility and watching closely), I think you can be long Marine Shipping.

I’m sure the names below, are names you’ve never heard of, but that’s ok.

They’re Billions of dollars in Market Cap with solid fundamentals and good charts, I don’t need to know any more than that.

Golar Lng (GLNG)

The GLNG chart has broken out of a massive base and had already moved 15%, our members have done very well on this already, but as we’re now reaching an over bought condition with RSI, so we can reasonably expect a pull back.

If there IS a pull back, provided it’s above $15.50, I like it.

ZIM Integrated Services (ZIM)

First things to say, ZIM reports earnings today, and I’m going to be watching the reaction to the report very closely.

If it puts in a confirmed break out above $76 on the back of positive numbers, what’s not to like?

There are a few areas doing ok just now and holding up well, but having tolerance for volatility is probably needed going into anything new.

There’s a fine line between being weak handed and risk management, so whatever your approach is, stay safe out there.

If you missed the YouTube Social Media freebie at the weekend, there are another 20 Ideas and Charts laid out below.

Our Time Stamped Market Calls