Daily Market News - 3rd August 2022

The Bull Case For Gold

If you picked up last weeks letter and did well on the bottom calls on PYPL and TSLA - LETTER HERE

You’re welcome.

Our clients and members got those charts the week before. They’ve been great.

In this weeks letter I’m going to make the case for a complete disaster area of the market. Gold.

Over the last few years, it’s been a frustrating place to be allocated, but are we now starting to see the Fundamentals aligning with the Technical signals?

Lets look at a few charts.

SPDR Gold Shares ETF (GLD)

You might’ve seen me post this chart to Twitter a couple of weeks ago highlighting a fairly significant support level for Gold. What I like about charts like these is they’re easy to define the risk and there’s usually a reward proposition that makes sense.

Above Support, I think Gold makes sense.

Relative Rotation Graph (RRG Gold)

This is a chart many of you won’t have seen before.

It tells us what’s outperforming (or likely to out perform) the S&P500.

To keep it simple, we’re looking for stocks moving into the Green (LEADING) quadrant. While these names could reverse course at any moment (something I keep on top of daily), if they start to outperform, they could get interesting.

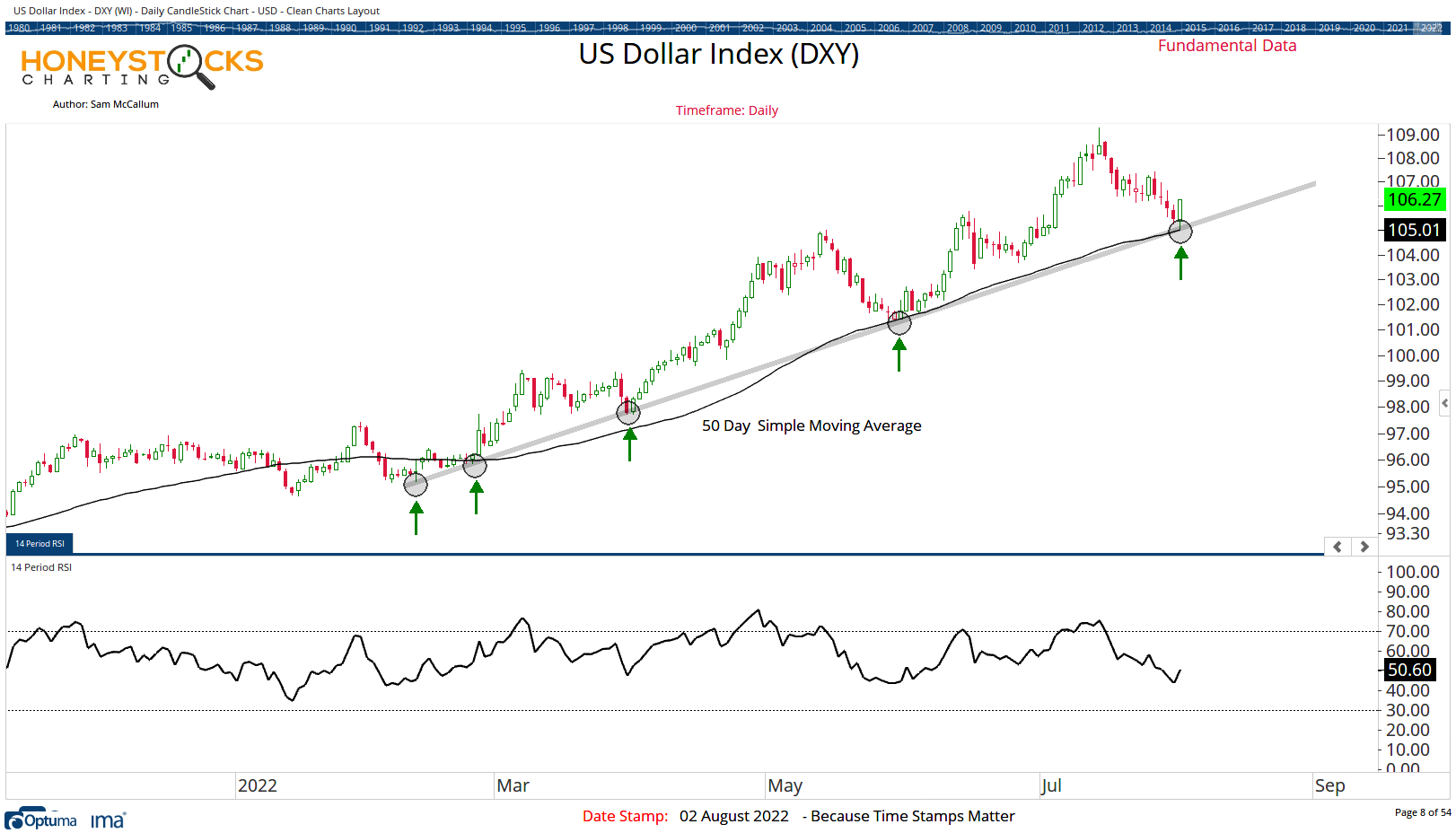

US Dollar Index (DXY)

For those new to my work, I don’t use magical hindsight indicators.

The US Dollar’s been a big part of my thesis for a bear market rally over the last month (I called a bottom a month ago)

A VIOLET RALLY IN THE MAKING LETTER HERE

Much of my work over the last 5 weeks has seen many individual stock moves of anywhere between 20-50%.

As far as I’m aware, we’re the only firm to call the exact bottom of the rally.

If the USD rips higher, that might be an environment where the major averages come under pressure again. So I’ll be watching this chart closely because the rally could quite conceivably end right here, and while the inverse correlation could come undone at any moment, I do think Gold could potentially be the 1 to step up to the plate. I’ll be watching.

If you missed my social media analysis at the weekend, feel free to check that out below.

Our Time Stamped Market Calls