Daily Market News - 3rd November 2022

The Fed Fun House

Now that we have the FOMC carnival out the way, the focus for me now switches back to the charts.

The immediate aftermath didn’t inspire much confidence with the S&P500 giving up 2.5% and the QQQ’s giving up 3.5%.

October was a massive month. We closed out with 1 of the best months on record. November promises to be a little more challenging.

In this weeks letter, I’m going to share a few areas of the market I believe could be setting up to become the NEXT leaders.

But I want to start with the value vs growth debate because I get asked a lot.

The chart is currently telling us value is rising against growth. It’s been telling us that for a while. It’s why my work has been focussed away from all the growth tech names that everyone seems to gravitate toward.

I don’t want to be that market analyst who talks about the magical hindsight indicator so I’ve attached a stock list below.

It’s a complete list of charts provided to our clients as buy recommendations over the last month

Aside from 2 risk : reward propositions in AMZN and GOOG (which just didn’t get moving), and a bullish call on semiconductors SMH (which has been unbelievably good), my work has been largely focussed away from “growthy” tech.

My criteria is simple. Base bottoms, rising relative strength, and failed moves on beaten up areas.

That said, the US Dollar is going to decide a lot, just as it has over the last 12 months.

DXY looks to be resuming its uptrend after pulling back hard over the last few weeks.

My thesis coming into October of Dollar down, Euro up and stocks up looks to be coming to an end.

The Euro (FXE) just hasn’t got going, but I still believe there are potential opportunities in many areas.

As always, price will need to confirm these moves above the levels highlighted.

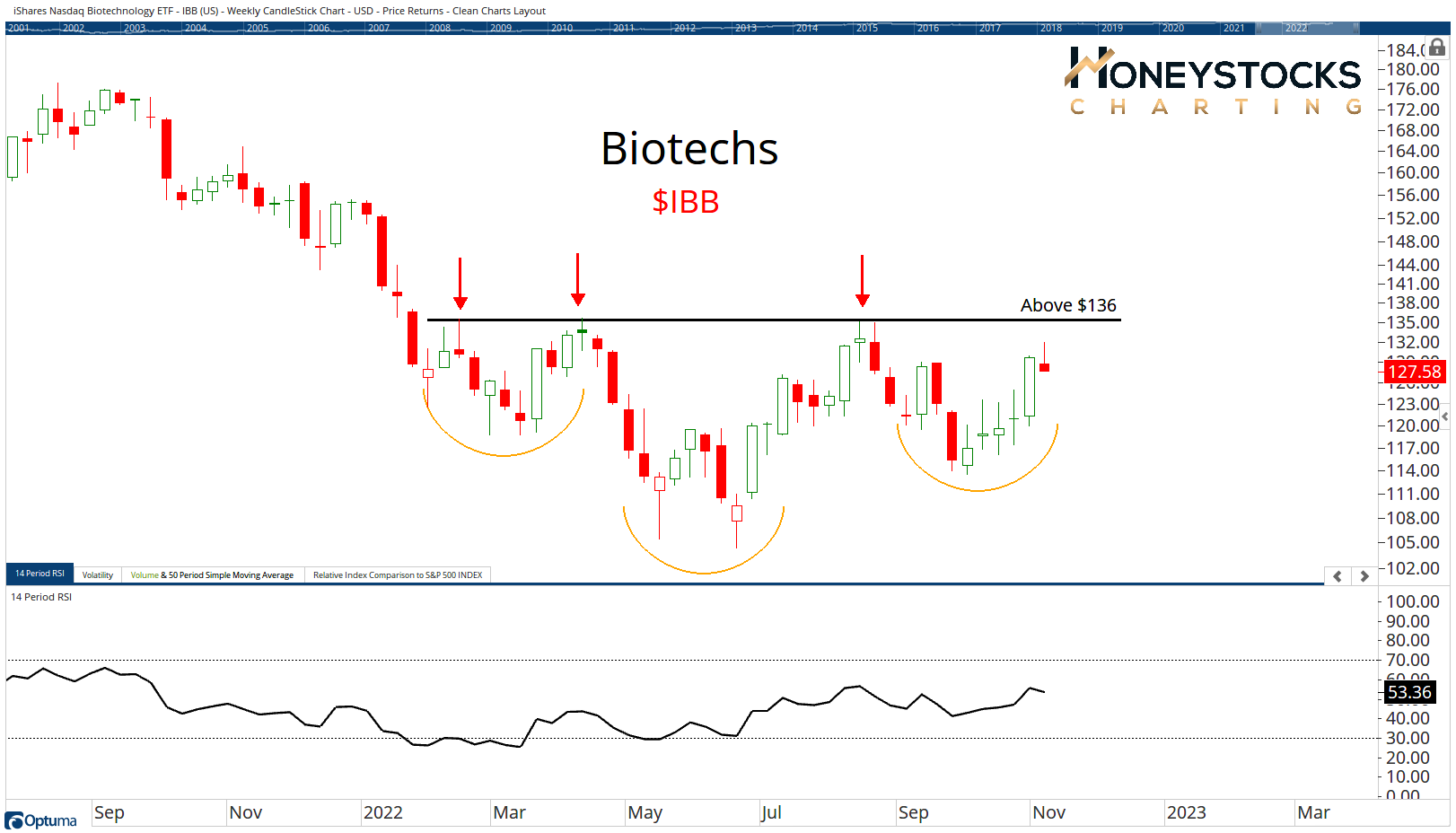

With that in mind, lets take a look at Biotech’s.

The chart is potentially be setting up technically. (provided the market doesn’t collapse)

A move ABOVE $136 would give me the conviction I need to make an outright bullish call on Biotech’s.

I understand the chart goes against the Value vs Growth narrative, but that doesn’t mean we can’t see out performance when we see these short term rotations.

Next up - Marine Shipping

Marine Shipping names are -37% from their ATH’s and if you’ve followed my work a while, you’ll know I like to pay attention to failed moves, and if $BOAT can make a move above $27, for me, I think there’s a bull case to be made.

You might observe from the list above there’s a couple of Shipping names in there with $ASC and $STNG already making big moves, but there are still a few names within the sector that look very interesting.

Copper Miners again are coming under pressure and are currently below key levels.

A move ABOVE $34 would be interesting for me in this sector

In Conclusion

After yesterdays Fed carnival, the charts are more important than ever.

Could the October rally be as good as it gets for a while?

I’m open to that possibility so I’ll be watching the charts closely.

What will you be watching?

All the charts above have been taken from our ETF Chartbook which is available to all our clients and members.

Our Time Stamped Market Calls